Payments in any industry or sector are the core of what makes a business run. It’s obvious. Fitness club managers cannot maintain the upkeep, management or growth of their gyms unless their revenue comes in smoothly and on time. For members, paying membership fees are a necessary evil; one they would rather not have to engage with every month.

As a result, payment providers have long been the bridge between which business to customer transactions happen. Before digitization of the consumer marketplace, gyms were the best option to pursue fitness. Now, the explosion of mobile fitness apps, smart home gym equipment and increased consumer interest in health and wellbeing has made the fitness industry extend far past traditional perceptions of needing a gym membership. And within that, fitness facilities in particular, have become a saturated niche.

SaaS payment providers are there to help gym managers run and scale their businesses in the midst of this hyper-competitive marketplace. However, these providers are often overlooked when they should be interrogated on the fit they have with a gym’s overall member-focused strategy.

Problems of Using Legacy Payment Providers for Gyms

Payment providers, such as GoCardless, Stripe and Adyen fulfill a basic but major operational need for gyms. However, while payment providers are an established industry with tried and true methods, the sector has remained stagnant in terms of their innovation and customer service for several years. Myles McLaren, fitness relationship manager for the direct debit payment provider GoCardless, explains:

“Within the fitness space, direct debit [has] been used forever, but it's been stuck in a kind of a rut. It’s stayed in the traditional methods of how direct debit should be used, which is inflexible, quite structured and not member experience friendly.”

This lack of transformation and consumer-centric thinking within the payment industry is problematic for the great member experience facilities are not expected to deliver.

At large, payment providers still enforce penalties, lack transparency and reserve control over how and when payments can be made.

For example, many payment providers release little or no flexibility over the day of the month a direct debit comes out of a member’s bank account. Because of the inflexibility to allow members to choose, people without a fixed monthly income, such as freelancers and commission-based salespeople, effectively have their hands tied as to whether a gym payment will bounce or not.

In addition, when a payment does bounce (most likely due to lack of funds) a prevalent policy dictates that the payment provider must charge the end customer a ‘late fee’ sum of around 25$ for each re-try that happens every few days.

The inability to choose the debit day paired with hidden penalty costs leave little control for the member to manage their own bills and finances. If a direct debit payment does fail, members can become wary of running up extra fees.

According to Myles, the use of the ‘late fee’, which was initially designed to incentivize members to pay on time, can actually backfire and chip away at a fitness facility’s membership base.

“If you treat your member terribly, you may experience that they're going to find someone who doesn't do that. And they're going to find somewhere where the experience is seamless, rather than it being a hassle for them.”

Receiving declined payment emails and mounting penalty fees, in spite of the loyalty shown to a fitness brand beforehand, harms member experience, repelling people from a brand and wasting gym retention efforts.

As a former gym owner, current GoCardless partner marketing manager, Tom Metcalfe, agrees that such penalties and inflexibility on the side of payment providers is counter-intuitive.

He says that as a gym owner, “...you work so hard all the time to gain members. But then you’re losing them just because they're scared that their payments’ going to fail or that they don't want to have their payments fail. People will cancel their memberships with their gym because they don’t want to incur a 25-pound charge.”

Payment Provider Disruption to the Rescue

In response to the rigid and limiting policies payment providers have in place concerning businesses and their consumers, a new, more human and disruptive approach is beginning to stir in the payments industry.

Some forward-thinking payment providers, such as the British-based company, GoCardless, have decided to go against the grain and start tailoring their services to prioritize their client’s customers.

In a study conducted by GoCardless in partnership with YouGov, it was found that ¾ of the sample claimed that they would expect to have an online payment service when purchasing services.

However, too often payment providers do not have the features to allow customers to set up and control their own direct debits.

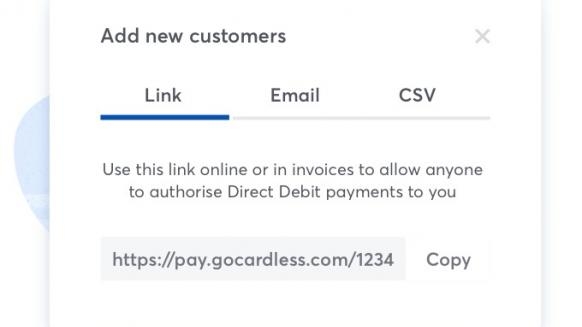

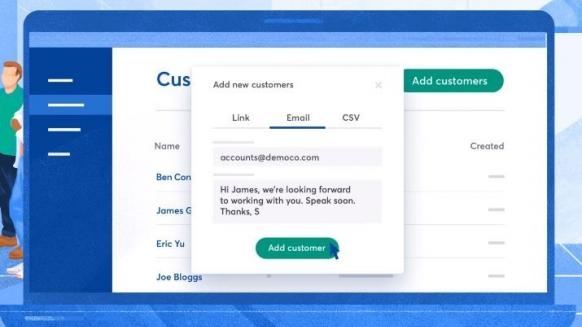

Clients crave convenience. But if payment providers refuse to move direct debit set-up online, then gym managers have to insist that people come into their facility to sign up for memberships personally. Such an effort won’t help increase a gym’s client base.

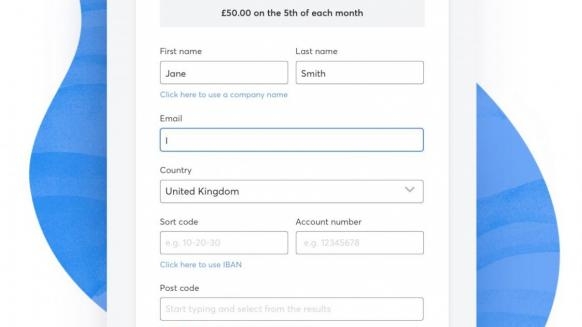

As convenience becomes a major customer trend, emerging payment providers are disrupting traditional payment methods by allowing members to set up their direct debit unaided online. This helps fitness members gain more control over their own gym bills, consequently opening opportunities for fitness clubs to gain more membership sign-ups as a result.

In addition to this, payment disruption is not only giving flexibility over how a direct debit is paid, but also when it is paid. For the most part, payment providers don’t allow businesses or their clients to choose the date the direct debit transfer happens, which limits both business and customers.

However, new payment providers, such as GoCardless, are allowing their business clients or customers to choose the date on which a direct debit is fulfilled. The date can then be changed at any time to suit the lifestyle of the customer or the needs of the business.

Giving such a payment option increases member happiness and reassures gym managers that the payment will not fail when the time comes, reducing administrative headaches and keeping the customer-facility relationship strong.

Unlike other client-facing industries, gyms typically work on a monthly subscription model, which means a facility’s main source of revenue is characterized by low value but high volume payment transactions. To ensure correct payments are made, facilities should choose disruptive payment providers who focus on flexibility for both facility and customer when setting up direct debits.

Examples of Payment Provider Disruption for Gyms

When approaching payment providers, gym managers should bear in mind how the service not only helps them but also how it helps their members too. First and foremost, payment providers need to be reliable. Failed payments lead to stress and extra effort to be taken on both the fitness club and member side of things. Granted, direct debits sometimes fail due to insufficient funds and gym managers and payment providers can’t stop that, but gym managers should still look for providers who value transparency.

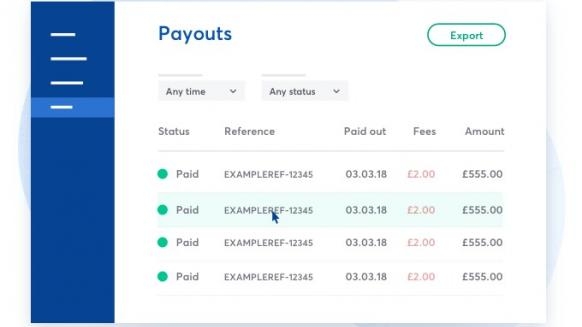

Providers, such as GoCardless, are able to integrate with club management software, allowing gym managers to check the real-time status of their payments right in their club’s system. In addition, as a contingency plan, GoCardless also notifies their clients via email whenever a member payment has been missed or something has gone awry. Maintaining this extra layer of communication between gym and payment provider empowers gym managers to learn about, and react to facility problems sooner rather than later.

In addition to this, in order to provide better customer experience, the use of payment provider debt collection and late fees should be eliminated. Gym managers instead should choose a provider who understands and looks after their members. After all, when it comes to failed payments, a little empathy and patience can go a long way to elevate customer loyalty.

Rather than penalizing a member with a late fee to remind them their membership is overdue, gym managers can use their club management platform to send personalized and effective emails instead. This helps members feel more understood by their facility and also eliminates the potential of customer complaints to gym managers about unanticipated charges.

GoCardless has rejected applying late fees for failed DD payments. Instead, they are currently developing a machine learning algorithm which learns which day will be the most successful for a payment to be made. If a payment bounces, then the algorithm will select the next retry day based on past data of successful payments. Though still in the creation phase, when the algorithm is ready for release, GoCardless, thanks to the use of personalized member data, will be better equipped to lessen the administrative stress of failed payments for both members and gym managers.

“It’s a win for everyone.” emphasizes Myles, “The customer doesn't have a massive charge, and this then lowers the actual failure rate to lower than 1%, which for businesses means that they get their money and increase their cash flow.”

From a fitness facility perspective, payment providers should also be allowing flexible and automated financial reporting. Rather than input the financial data manually and waste precious time, disruptive payment providers should work with an open API which can then be used to integrate with gym management software.

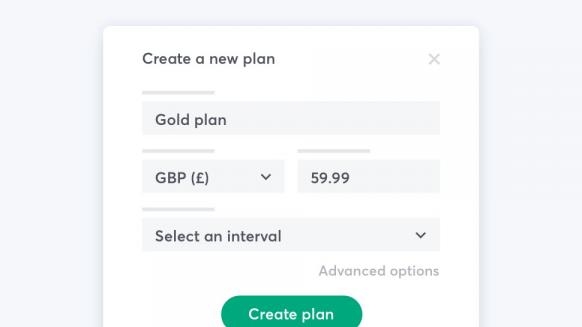

Recently, PerfectGym partnered with GoCardless to integrate our club management software and their payment system. With PerfectGym’s reporting function, managers who use GoCardless can create an array of payment reports at the touch of a button. With such a feature, gym managers can export their data to prove results and gain insights, as well as free them from pesky financial administrative tasks.

The Bottom Line

To gain an advantage over competitors, gym managers need to improve their members’ entire customer experience, not just their fitness experience.

To achieve this, an all-in-one gym management system is needed which can integrate smoothly with other service providers, so gym owners can have the flexibility to give members a seamless, high-caliber experience both in the gym and online.

With such holistic software powering a facility, staff can worry less about the management of their important payments. Running a brick and mortar business becomes smoother when juggling software stops and time is freed up. This allows a fitness facility to focus their energy on growing their business and listening to and helping their members.

Brand advocates are incredibly powerful in the marketplace today. According to invespcro.com, people are 90% more likely to trust and buy from a brand recommended by a friend. Thanks to a decrease in administrative management, gym owners can work to improve customer happiness, raise brand perception and turn customers into brand advocates. As Myles comments, “The more members are likely to stay, the more likely they are to grow with you and increase your revenue.”

By choosing a payment provider that genuinely focuses on the customer experience, a gym can benefit more with increased customer satisfaction and heightened brand perception than if they chose a provider who simply chases failed direct debit payments.

Key Takeaway

Gym owners need to be diligent about their own business ecosystem to ensure they are delivering the best experiences to their members across the board. While fitness takes place within the confines of a gym, other areas of customer service have become automated. Services such as online bookings, payments, direct debit set-up, communication and membership management are all essential to running a brick and mortar business.

When choosing among the onslaught of digital fitness management tools, clubs need to ensure their own business strategy and the strategy of their service partners are geared toward benefiting members. Using services dedicated to anything less than this can undermine a facility’s customer loyalty, obstructing a fitness club from evolving from the facility of choice to the brand of choice.